Within the realms of employment and health insurance coverage lies an important statute—the Consolidated Omnibus Budget Reconciliation Act—which is typically referred to by its commonly-known acronym, “COBRA.” The COBRA law protects employees by providing for continued health insurance coverage after their employment ends or changes. Knowing your COBRA rights is important so that you do not lose out on continued insurance coverage your current or former employer may be required to provide.

What is COBRA?

COBRA entitles employees and their families to continue group health benefits under their previous employer’s group health plan under the situation in which an employee’s work situation changes. The matter in which the employee’s work situation changes is important to note when an employee is looking to qualify for COBRA coverage.

COBRA coverage is required under the following circumstances:

- The employee must have been a member of a qualified group healthcare plan.

- The employee must have undergone a “qualifying event”, which most commonly include voluntary/involuntary job loss (unless gross misconduct is involved), retirement, the death of the employee, a reduction in hours worked, a divorce leading to coverage loss, the employee qualifying for Medicare, and the loss of the dependent status under the group healthcare plan’s terms.

- The employee must continue to pay the full premium (the former employer’s share and the employee’s share plus a 2% administrative fee).

The employer must have the following for an employee to qualify for COBRA:

- 20 or more full-time employees.

- A group healthcare plan that is sponsored by the state or local government.

- The employer must not be the federal government.

I have qualified for COBRA…what is my employer required to do?

If an employee qualifies for COBRA coverage based on the above prerequisites, the employer must provide the employee with written notice explaining the former employee’s COBRA rights as a result of job loss. It is then up to the former employee to decide whether to continue the health care coverage under the former employer or find other coverage.

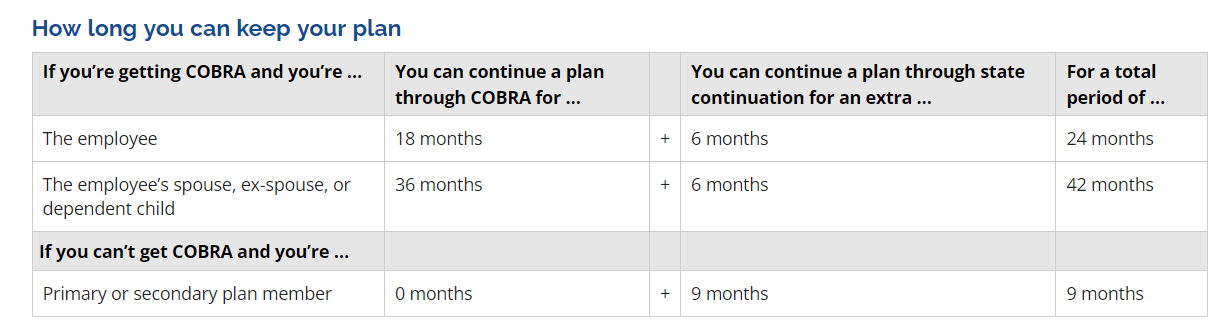

If the employee elects to continue coverage, the employee must notify their former employer in writing of the decision to continue their coverage within 60 days of receiving the written notice from the former employer. COBRA law stipulates that the qualified former employee and their family has the right to remain on the former employer’s health plan for up to 18 months. However, it may be extended to 36 months under certain circumstances. If the former employee has a disability, they can get coverage for an additional 11 months after COBRA coverage ends, which the Social Security Administration would determine the definition of disability in this matter.

I don’t qualify for COBRA…What do I do?

Even if a former employee doesn’t qualify for COBRA, in the state of Texas, the former employee may still be provided with coverage per Texas law that outlines coverage continuation rights. The following chart from the Texas Department of Insurance website illustrates coverage former employees may be entitled to:

The former employee must, however, have had coverage for 3 months before the end of a job. It must also be recognized that state continuation does not apply to self-funded plans or non-group plans as the state doesn’t regulate those plans. A former employee is not eligible for state continuation coverage if they were fired.

The former employer is required to inform the former employee about the continuation of coverage within 30 days from the date of when the job ended.

How do I start this process?

Getting COBRA benefits from your former employer is important (and sometimes less expensive than other options), and while we wish all employers did the right thing every time, the truth is that sometimes it helps to have a lawyer on your side. If you’ve lost your group healthcare coverage at work, think you and your family may qualify for a temporary extension of benefits, or have found it difficult to obtain the coverage you’re entitled to, the attorneys here at Minces Rankin PLLC can help.

We offer affordable consultations and are available to consult with you to clearly outline your legal rights and the best options for you moving forward and, if you need us, to advocate on your behalf so you can receive whatever COBRA benefits you are entitled to. Contact us today for more information on how we can get the coverage you qualify for back to you.